Your Cart is Empty

TALK TO AN EXPERT: 1-844-945-3625

Menu

-

- Water Filter Systems

- Portable Solar Generators

- Propane Wall Heaters

- Composting Toilets

- DIY Buildings & Kits

- Canvas Tents

- Homestead & Off Grid Supplies

- Harvest Right Freeze Dryers

- Emergency Food Kits

- Hunting Blinds

- MrCool DIY Mini Splits

- Solar Air Conditioners

- Solar Fridge & Freezers

- Camping Coolers

- Overlanding Gear

- Two Person Cots

- Portable Sauna Tents

- Incinerating Toilets

- Dairy Equipment

- Faraday Defense

- EMP Shield

- Hunting Blinds

- Compost Tumblers

- Drip Irrigation Kits

- Shade Cloth

- Propane Fireplace

- Portable BBQ's

- Brands

- Chicken Coop Brands

- Composting Toilet Brands

- Solar Brands

- Food Storage Brands

- Freeze Dryer Brands

- Water Filtration Brands

- Incinerating Toilet

- Waterless Toilet Brands

- Heater Brands

- EMP Shield Brands

- Tent Brands

- Cot Brands

- Cooler Brands

- Dog Kennels

- Greenhouse & Gazebo Brands

- Portable Saunas

- DIY Shed Kits

- About Wild Oak Trail

- Resource Center

- The Ultimate Prepper & Emergency Survival Blog - Includes Free eBook

- Beginners Guide to Living off The Grid - Includes Free eBook

- Building Your Own Emergency Food Supply

- Best Survival Food to Be Prepared for Anything

- Berkey Lab Tests & Certifications

- Federal Solar Tax Credit - What You Need to Know

- BLOG

-

- 1-844-945-3625

- Login

TALK TO AN EXPERT: 1-844-945-3625

Sale

Rich Solar All In One Energy Storage System

$5,599.99 - $8,999.99$6,999.99

✅ Authorized Dealer for Rich Solar

- 🚛 Free Shipping within the lower 48 states!

- 🏗️ Engineered in the USA, using high-efficiency and long-lasting solar technology

- ⚙️ 25-Year Power Output Warranty on panels and 5-Year Limited Warranty on electronics

- 🏆 Trusted by thousands of off-grid homeowners, RV travelers, and solar professionals across North America

Have Questions?

Chat, Call, or Text a Specialist

Found a better price? We will match or beat it! 1-844-945-3625

×

Connect With Us

We match or beat any competitor's price!

1-844-945-3625

Mon-Fri 10am-5pm CST

After hours? Text us and we'll reply ASAP!

After hours? Text us and we'll reply ASAP!

- Description

- Federal Solar Tax Credit

- Best Price Guarantee!

- Why Buy From Us

Description

All In One Energy Storage System by Rich Solar

Introducing the Rich Solar All In One Energy Storage System your all-in-one and cutting-edge solution to redefine the way you harness and utilize solar energy. This state-of-the-art inverter and efficient battery storage, this system provides an unprecedented level of energy independence. Can also be integrated with Rich Solar Panels for a Solar Experience like no other.

Click here to access Rich Solar All In One energy User Manual

Features:

Pure sine wave outputOff-Grid applicationProgrammable supply priority for PV, Battery or GridUser-adjustable battery charging currentBattery independent design Multiple communication for USB, RS232, SNMP, Modbus, GPRS and Wi-FiMonitoring APP (Android and iOS) for real-time status display and parameter controlBuilt-in 2 MPPT trackers and AC/Solar charger up to 120ACompatible with utility and generatorScalable Li-Ion battery expansion

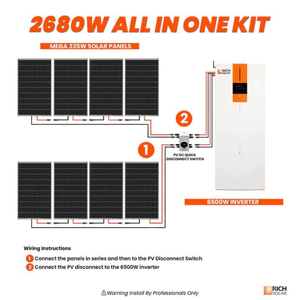

How to Setup Your All In One Energy Storage

SPECIFICATIONS

Model: RS-A10

Maximum PV Input Power: 8000W

Rated Output Power: 6500W

Maximum Charging Power: 6500W

BATTERY:

• Nominal DC Voltage: 48 VDC

• Maximum Charging Current: 120 A

• Dimension: (D x W x H): 8.4″ x 24.4″ x 19.7″

• Net Weight: 99 lb

• Capacity: 5120Wh

• Nominal Voltage: 51.2VDC

• Full Charge Voltage(FC): 56V

• Full Discharge Voltage(FD): 42V

• Typical Capacity: 100 Ah

• Max Continuous Discharging Current: 120A

• Max Discharging Current: 192A at 1 min

• Protection: BMS, Breaker

• Float Charge Voltage: 52.5V

• Charge Current: 20A (0.2C)

• Maximum Charge current: 50A (0.5C)

• Standard Charge method: 0.2C CC (Constant current) charge to FC,CV (Constant voltage FC) charge till charge current decline to <0.05C

• Inner Resistance: ≤20m ohm

PV INPUT (DC):

• MPPT Range @ Operating Voltage: 90 ~ 230 VDC

• Maximum PV Array Open Circuit Voltage: 250 VDC

• Maximum Solar Charge Current: 120A

• Number of MPP Trackers / Maximum Input Current: 2 / 2 x 18 A

AC INPUT:

• Acceptable Input Voltage Range: 90-140 VAC (For Computers)

• Acceptable Input Voltage Range: 80-140 VAC (For Home Appliances)

• Maximum AC Input Current: 60A

BATTERY MODE OUTPUT:

• Nominal Output Voltage: 120 VAC

• Maximum Conversion Efficiency (DC/AC): 93%

PHYSICAL:

• System Dimension (D X W X H): 19.7″ x 26″ x 49.2″

• Net Weight: 287 lb

Federal Solar Tax Credit

A Brief Overview of the U.S. Home Energy Tax Credit

Discover the financial advantages of the U.S. federal solar tax credit for homeowners considering installing a solar system in their main residence. This incentive provides a 30% discount on the current cost of a solar system. If you've set up a system in 2022, it's advisable to speak with your tax consultant to see if you're eligible for a higher credit rate.

Understanding the U.S. Federal Solar Tax Credit:

This tax credit is tailored for homeowners and applies to solar systems installed in primary homes. The credit covers a percentage of qualifying expenses, and thanks to the recent Inflation Reduction Act, the scope of the Investment Tax Credit (ITC) has broadened. Solar systems installed from 2022 to 2032 are eligible for a 30% tax credit, which will drop to 26% in 2033 and 22% in 2034. There's no cap on the amount you can claim.

What Expenses Are Eligible:

Qualifying expenses include solar photovoltaic panels, attic fan power systems (except for the fan itself), labor costs for installation and setup, balance-of-system components, and applicable sales taxes. Standalone batteries with a capacity of 3 kWh or more may also be eligible! For instance, if the solar system you initially purchase includes a single battery with a capacity of less than 3 kWh, but you also buy extra batteries during the installation process that bring the total capacity to more than 3 kWh, then the entire setup may be eligible for the tax credit.

How to Determine Your Eligibility:

To confirm your eligibility for this federal solar credit, review the guidelines set forth by the U.S. Department of Energy and consult your tax advisor.

Steps to Claim the U.S. Federal Solar Tax Credit:

Verify Eligibility: Speak with your tax advisor to confirm your eligibility and to understand how to make the most of the credit.

Fill Out IRS Form 5695: This form, available online, is specifically for claiming renewable energy credits. Guidelines for completing the form are provided.

Apply Credits on Your 1040: Use the total credit amount from Form 5695 to lessen your tax liability on your Form 1040.

Disclaimer:

Always consult your tax expert to fully understand your eligibility for tax credits based on your unique situation. Wild Oak Trail offers this guide for educational purposes and does not assure tax credits based on the information given. This resource should not replace professional tax or financial advice and should not be the only factor in your purchasing, investment, or tax choices. Consult a tax expert for a personalized evaluation.

Additional Resources:

Best Price Guarantee!

Best Price Guarantee

You'll get the best price available at Wild Oak Trail! We'll match anyone who has it lower!

We love to chat! Give us a call and we'll see what we can do to get you the best deal!

Conditions of our 100% Price Match Guarantee:

-

Contact us to discuss the Price Match so we can look up the competitors price

-

Buy one, get one free offers and Rebates are not eligible

-

The item must be in stock on the competitors website

-

The competitor must be an online store, not a retail location

-

The website can't be a discounter or auction website ( such as eBay, overstock, etc.)

-

The company must be an Authorized Retailer of the product in question

-

The Price Match Guarantee is based on the final price of the product including shipping and taxes

Why Buy From Us

Why Buy From Wild Oak Trail?

We’re a family-run business. My Wife Hailey and I run this business with our small staff of 3 awesome people. When you shop with Wild Oak Trail, you're supporting real people, not a big corporation.

We truly care. We’re here before, during, and after your purchase. Good products and great service—that’s how we earn your trust. We see and celebrate EVERY sale that comes in!

We choose quality. If we wouldn’t use it ourselves, we won’t offer it. Our goal is to make you happy enough to tell your friends.

Thanks for supporting our family and being part of the Wild Oak Trail community!